|

Exam-Style Questions on FinanceProblems on Finance adapted from questions set in previous Mathematics exams. |

1. | GCSE Higher [529] |

Elaine invests £150 000 in a savings account for six years.

The account pays compound interest at a rate of 1.2% per annum.

Calculate the total amount of interest Elaine will get at the end of the six years to the nearest pound.

2. | GCSE Higher [312] |

Winky Lash wants to invest £20 000 for 3 years in a bank. She has the following two choices of banks, both offering compound interest but on different terms:

Leftway Bank1% AER |

::-:: | Righton Bank2.1% for the first year |

Which bank will give Winky the most interest at the end of the three years?

Show all of your working.

3. | GCSE Higher [691] |

(a) Davy Browning earns £54000 per year before paying tax.

He pays tax on his earnings at a rate of 18%.

He pays tax on his earnings at a rate of 18%.

Calculate the amount Davy has after paying tax.

(b) Patty O’Dawes earns £57810 per year after paying tax at a rate of 18%.

Calculate the amount that Patty earns before paying tax.

(c) Davy opens a savings account with £2500.

The account pays 2.4% per year simple interest.

Calculate the amount in Davy’s account at the end of 5 years.

(d) Patty opens a savings account with £500 at the same time ad Davy.

The account pays 2.1% per year compound interest.

Patty pays another £500 into her account on the same day every year.

Find who has the greater amount in their account at the end of 5 years.

4. | GCSE Higher [122] |

The Griffiths family from London are going on holiday to Thailand.

They have a total of £1200 which they want to change into Thai baht but can't decide whether to change all of the money at once or in two instalments of £600.

They see this deal in a Currency Exchange Bureau.

Great Rates

Get 51 baht for £1 on amounts less than £800

Get 52 baht for £1 when you change £800 or more

How much extra money do they get by exchanging all of their money in one transaction?

5. | GCSE Higher [126] |

Michael Banks invests £2000 in a savings account for two years. The account pays 2% compound interest per annum.

Michael has to pay 15% tax on the interest earned each year. This tax is taken from the account at the end of each year.

How much money will Michael have in his account at the end of the two years? Give your answer to the nearest penny.

6. | GCSE Higher [141] |

The value of a new house, \(V\), is given by:

$$V = 120000 × 1.1^t$$where t is the age of the house in complete years and V is in pounds.

(a) Write down the value of V when t = 0.

(b) What is the value of V when t = 4?

(c) After how many complete years will the house’s value rise above £200 000?

7. | GCSE Higher [183] |

Here are the details for two bank accounts.

Dayter Bank

2% per year compound interest.

No withdrawals until the end of three years.

Rivver Bank

3% interest for the first year

2% for the second year

1% for the third year.

Withdrawals allowed at any time.

Saviour has £2000 he wants to invest.

(a) Calculate, to the nearest penny, which bank would give him most money if he invests his money for 3 years.

(b) Explain why he might not want to use Dayter Bank.

8. | GCSE Higher [281] |

Montague invests £7000 for six years in a bank offering compound interest at \(x%\) per annum.

The investment is worth £7654.10 at the end of the six years.

Find the value of \(x\).

9. | IB Studies [88] |

Helena is going for a holiday to France. She changes 900 Singapore Dollars (SGD) into Euros (EUR) with no commission charged. The exchange rate between EUR and SGD is:

1 EUR = 1.49 SGD

(a) Calculate the value of 900 SGD in EUR to the nearest whole number.

At the end of Helena’s holiday in France she has 155 EUR. She converts this back to SGD at a bank, which does not charge commission, and receives 227.85 SGD.

(b) Find the exchange rate of this second transaction.

(c) Determine, when changing EUR back to SGD, whether the exchange rate found in part (b) is better value for Helena than the exchange rate in part (a). Justify your answer.

10. | IB Studies [109] |

On Billy's 16th birthday his parents gave him options of how he might receive his monthly allowance for the next two years.

Option A £55 each month for two years.

Option B £10 in the first month, £15 in the second month, £20 in the third month, increasing by £5 each month for two years.

Option C £15 in the first month and increasing by 10% each month for two years.

Option D Investing £1200 at a bank at the beginning of the first year, with an interest rate of 5% per annum, compounded monthly.

Billy does not spend any of his allowance during the two year period.

(a) If Billy chooses Option A, calculate the total value of his allowance at the end of the two year period.

(b) If Billy chooses Option B, calculate the amount of money he will receive in the 15th month.

(c) Calculate the total value of his allowance at the end of the two year period if he chooses Option B.

(d) If Billy chooses Option C, calculate the amount of money Billy would receive in the 15th month.

(e) Find the total value of his allowance at the end of the two year period if he chooses Option C.

(f) If Billy chooses Option D, calculate the total value of his allowance at the end of the two year period.

(g) State which of the options, A, B, C or D, Billy should choose to give him the greatest total value of his allowance at the end of the two year period.

Another bank guarantees Billy an amount of £1650 after two years of investment if he invests $1200 at this bank. The interest is compounded annually.

(h) Calculate the interest rate per annum offered by the bank.

11. | IB Applications and Interpretation [444] |

Mr and Mrs Moule are considering purchasing a new car with a price of £12000

The dealership offers two options to finance a loan.

A five year loan at a nominal annual interest rate of 12 % compounded quarterly. No deposit is required and repayments are made each quarter.

(a) Find the repayment made each quarter.

(b) Find the total amount that will have been paid for the car by the end of the five years.

(c) Find the total amount interest that will have been paid on the loan by the end of the five years.

A five year loan at a nominal annual interest rate of \(r\)% compounded monthly. An Initial 12% deposit is required and monthly repayments of £255.

(d) Find the annual interest rate, \(r\).

(e) State which option Mr and Mrs Moule should choose and justify your answer.

This new car will depreciates at an annual rate of 20% per year.

(f) Find the value of Mr and Mrs Moule’s car when it is ten years old.

12. | IB Analysis and Approaches [750] |

Ramin buys a car for £25,000. The value of the car decreases by 20% in the first year.

(a) Find the value of the car at the end of the first year.

After the first year, the value of the car decreases by 15% in each subsequent year.

(b) Find the value of Ramin’s car 12 years after he buys it, giving your answer to the nearest pound.

When Ramin has owned the car for \(n\) complete years, the value of the car is less than 20% of its original value.

(c) Find the least value of \(n\).

13. | IB Studies [15] |

All answers to this question should be given to the nearest whole currency unit.

Katie and Keith each have 9000 USD to invest.

Katie invests her 9000 USD in a bank account that pays a nominal annual interest rate of 3.8% compounded yearly. Keith invests his 9000 USD in an account that offers a fixed interest of 410 USD each year.

(a) Find the amount of money that Keith will have in the bank after 4 years.

(b) Find the amount of money that Katie will have in the bank at the end of 9 years.

(c) Find the number of complete years it will take for Katie’s investment to first exceed 12000 USD.

(d) Find the number of complete years it will take for Katie’s investment to exceed Keith’s investment.

Keith moves from the USA to Spain. He transfers 3500 USD into a Spanish bank which has an exchange rate of 1 USD = 0.89 euros. The bank charges 1.5% commission.

(e) Calculate the amount of money Keith will invest in the Spanish bank after commission.

Keith returns to the USA for a short holiday. He converts 900 euros at a bank in Rutherford, NJ and receives 1018.44 USD. The bank advertises an exchange rate of 1 euro = 1.15 USD.

(f) Calculate the percentage commission Keith is charged by the bank.

14. | IB Studies [13] |

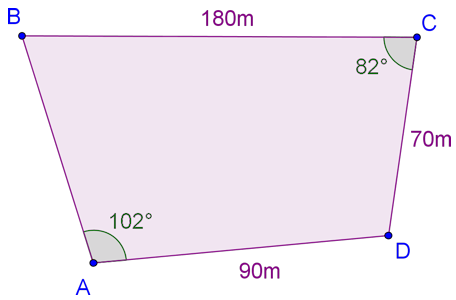

Christine owns a four sided piece of land shown in the diagram below as ABCD. The length of BC is 180 m, the length of CD is 70 m, the length of AD is 90 m, the size of angle BCD is 82° and the size of angle BAD is 102°. The diagram is not to scale

Christine decides to sell the triangular portion of land ABD. She first builds a straight fence from B to D.

(a) Calculate the length of the fence.

The fence costs 19 USD per metre to build.

(b) Calculate the cost of building the fence. Give your answer correct to the nearest USD.

(c) Show that the size of angle ABD is 28.6°, correct to three significant figures.

(d) Calculate the area of triangle ABD.

She sells the land for 110 USD per square metre.

(e) Calculate the value of the land that Christine sells. Give your answer correct to the nearest USD.

Christine invests 200 000 USD from the sale of the land in a bank that pays compound interest compounded annually.

(f) Find the interest rate that the bank pays so that the investment will double in value in 12 years.

15. | IB Analysis and Approaches [571] |

Two friends Arthur and Babette, each set themselves a target of saving £12000. They each have £6800 to invest.

(a) Arthur invests his £6800 in an account that offers an interest rate of 8% per annum compounded annually. Find the value of Arthur's investment after 6 years.

(b) Determine the number of complete years required for Arthur's investment to reach the target.

Babette invests her £6800 in an account that offers an interest rate of \(r\)% per annum compounded monthly, where \(r\) is set to two decimal places.

(c) Find the minimum value of \(r\) needed for Babette to reach the target after 15 years.

A third friend Callum wants to reach a £9000 target. He puts £4000 under his mattress where it does not earn any interest. His system is to add more money to his savings regularly. Each year he will add half the amount added in the previous year.

(d) Show that Callum will never reach the target if during the first year he adds £2000.

(e) Find the amount Callum needs to add during the first year in order to reach the target after 8 years.

16. | IB Analysis and Approaches [379] |

Ruby invests a certain amount of money in a bank account that pays a nominal annual interest rate of 6.7%, compounded quarterly.

The amount of money in Ruby’s account at the end of each year forms a geometric sequence with common ratio, r.

(a) Find the value of the Annual Equivalent Rate (AER) represented by r.

(b) If Ruby invested her money on the 1st January 2022, find the year in which the amount of money in Ruby's account will become three times the amount she invested.

If you would like space on the right of the question to write out the solution try this Thinning Feature. It will collapse the text into the left half of your screen but large diagrams will remain unchanged.

The exam-style questions appearing on this site are based on those set in previous examinations (or sample assessment papers for future examinations) by the major examination boards. The wording, diagrams and figures used in these questions have been changed from the originals so that students can have fresh, relevant problem solving practice even if they have previously worked through the related exam paper.

The solutions to the questions on this website are only available to those who have a Transum Subscription.

Exam-Style Questions Main Page

To search the entire Transum website use the search box in the grey area below.

Do you have any comments about these exam-style questions? It is always useful to receive feedback and helps make this free resource even more useful for those learning Mathematics anywhere in the world. Click here to enter your comments.